Roald Suurs, Elsbeth Roelofs

For a full-text report, please send an email to roald.suurs@tno.nl

Introduction

As part of its general innovation policy, the Dutch government wants to make sure that it provides positive conditions for innovative companies with biobased ambitions. For this reason, TNO was asked to investigate the factors that determine the investment climate for biobased chemical companies in Europe (and more particularly in the Netherlands). The following questions were central:

- Which criteria determine the outcome of planning biobased investment decisions?

- What is the relative country performance within and outside Europe?

- What are the specific barriers for investing in the Netherlands and Europe?

The results of the study indicate that, depending on the development stage of innovation activities, decision criteria will be dramatically different. Europe, and the Netherlands, are doing relatively well when it comes to supporting R&D but key improvements are necessary when the ambition is to move from R&D to demonstration and commercial production.

Approach

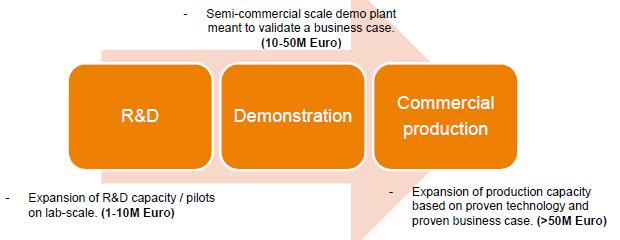

The results presented here are based on a quickscan, consisting of a short literature study and 20 interviews with industry leaders and venture capitalists. Interviews were directed at identifying key decision criteria for building either R&D facilities or pilots, demonstration plants or commercial scale production lines (see figure). The focus of the study was on companies developing and/or producing biobased chemicals.

- Excluding companies that exclusively produce bioenergy and biofuels.

- Excluding companies that exclusively produce feed and food.

Despite the narrow focus, a large variety of companies was involved, ranging from large waste processors and a sugar company to small pyrolysis or IB oriented technology start-ups.

Figure 1: Three categories of investment and typical budgets involved.

Which criteria determine the outcome of planning biobased investments?

The figure below provides an overview of criteria that were considered most important in deciding on go no-go / location of investments in R&D, demo’s and commercial installations.

Figure 2: For each type of investment the figure shows the average weight of each criterion considered for deciding on a go/no-go and/or choosing a location. Weights are calculated on the basis of a collection of ‘top 5’ rankings. A weight of 5 stands for an average rank score of 1; a weight of 1 stands for an average rank score of 5; a weight of 0 means absence from any individual top 5).

Based on the interviews the following explanations can be given for the relative importance of different criteria for the three categories of investment.

R&D capacity / pilot plants (network oriented)

- Generally speaking, investments are drawn to regions where professionals with the relevant knowledge are situated. The knowledge infrastructure (organisations, facilities, education level) is key in attracting and supporting these professionals.

- Biobased clusters are important for their network effects, pilot facilities and especially for their ‘marketing power’.

- Public financing, subsidies, are a lifeline for biobased pre-competitive R&D.

Demonstration plants / semi-commercial (risk oriented)

- Access to sufficient quantities of biomass feedstock at predictable and affordable costs is a requirement.

- Energy costs are a cost determining factor in the (bio) chemical industry.

- Moreover, investors seek to minimise the high costs and risks associated with this stage. Policy regulations directed at mitigating investment risks is therefore crucial.

- For the same reason, investors will usually look for a fit with existing site infrastructure (e.g. steam supply, heat outlet, logistics, safety services).

Commercial production / Upscaling (market oriented)

- Feedstock, infrastructure and energy costs remain very important criteria.

- The business case perspective is leading. Access to biobased markets is therefore an important additional criterion at this stage. Whether this affects a location decision depends on the type of product and company (how locally organized is the market for that company).

- Labour market conditions (e.g. costs and quality of operators) are key.

What is the relative country performance within and outside Europe?

Based on the key decision criteria for the three investment categories, it becomes clear that Europe’s strengths lie in the development of knowledge and networks. Critical weaknesses are the feedstock situation, energy costs, relative tax level and (other) financial incentives.

Some more detail on the most differentiating criteria for biobased companies making investment decisions are provided below:

Feedstock costs

- Wood prices (chips, pellets) in the EU are about three times higher than in the USA.

- Cost levels in the EU are modest where wood residues can be collected and transported over short distance. Still the prices are volatile.

- Global prices of sugar are currently highly volatile. Potential for upscaling sugar production is, by most respondents, believed to lie especially in Brazil and SE Asia.

Policy support

- A key strength of EU is the policy support for R&D.

- The EU has trouble supporting companies in bridging the ‘valley of death’.

- Tax levels are relatively high

- Lack of demand-side policies / public procurement initiatives

- Permits can be important for choosing specific regions within a country, but only after all other business requirements have been met.

Figure 3: Scaling up from pilot to demonstration remains a critical challenge. The key is a combination of measures to support risk mitigation (push) and market outlook (pull).

Knowledge infrastructure

- The USA and the EU are globally considered leading in biobased R&D.

- Growing competition is to be expected from China and Brazil.

- Important differences do exist between EU countries for specific areas of expertise (for example biotechnology is relatively big in the UK).

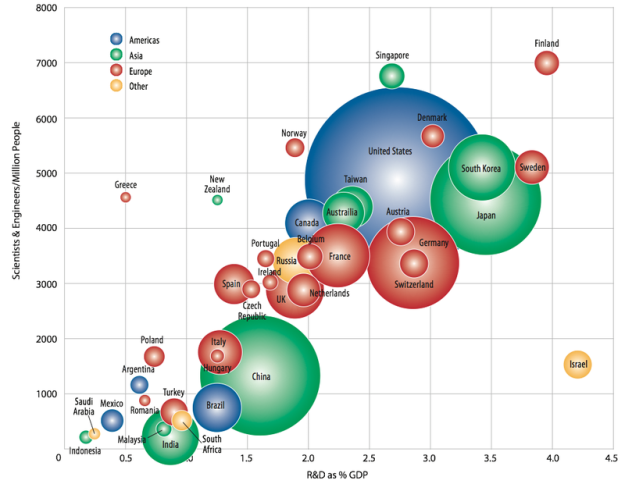

- The figure below provides a crude estimation of strengths in terms of R&D spending in general (not specific for biobased).

Figure 4: Global R&D spending 2011. Size of circle reflects the relative amount of annual R&D spending by the country noted. Source: 2012 Global R&D Funding Forecast.

Figure 4: Global R&D spending 2011. Size of circle reflects the relative amount of annual R&D spending by the country noted. Source: 2012 Global R&D Funding Forecast.

Energy costs

- Energy prices are lowest in China and the USA. For the EU, energy prices are relatively high.

- Within the EU price differences are less significant.

- Cheap energy on the basis of coal (China) and shale gas (USA) comes with high ecological costs. Many biobased businesses consider this a liability from a CSR / branding perspective.

What are the specific barriers for investing in the Netherlands and Europe?

High feedstock costs / availability

- Subsidies for bioenergy seem to create artificially high prices for biomass

- Lack of incentives for farmers to innovate e.g. sugar quota

- Regional biomass supply is insecure

- Waste legislation is not adapted to circular economy concept

Lack of ‘valley of death’ capital

- Lack of risk capital

- Lack of government procurement programmes

- Conditions of government financing are often unfit for commercial parties:

- Obligation to form consortia

- Obligation to disclose knowledge

Limited market value biobased products

- Lack of market incentives for biobased products

- Limited consumer awareness of (advantages of) biobased products

- No level playing field for fossil and biobased applications

Burden of regulation

- REACH requirements press on biobased businesses (especially SMEs)

- Permit procedures (province, municipalities) take too much time

Fragmentation and lack of critical mass

- Biobased initiatives are spread too thin

- Lack of cooperation between regions

- Lack of international cooperation across Europe

Concluding remarks

In the face of international competition, what role is there for a European biobased chemical industry?

Which possibilities are there for strengthening the position of European feedstock producers?

Which possibilities are there for different EU countries / regions in specialising in forestry, agriculture or waste as key biobased resource

How can the Dutch and EU governments mitigate the risks of biobased investments, most importantly for the support of demonstrations plants?

Which possibilities are there for developing biobased markets within Europe and the Netherlands? How to stimulate consumer uptake of biobased products?

One idea that strikes me is that when you have a good idea of what the success and failure factors are, you should target them. I am guessing that R&D is doing so already, but maybe synergistic policy and research can make 1+1=3. So for example, take energy costs: there is probably little that Europe can do to make its energy supply competitive with the US in the short or even medium term. But this has long been the case, and European industry tends to squeeze out advantages by being more energy efficient, so that the overall energy costs are comparable, or at least not determinant for investment. I am sure that bringing down energy costs is a big focus for R&D, but are there policies targeting that effort? Could support for R&D and demonstration projects target investments in energy efficiency, or alternatives that are less energy intensive? A similar line of thinking could be applied to feedstock costs. These are also relatively fundamental and hard to change in the short term. If policy sees a fundamental disadvantage, rather than try to redress it (by for example subsidizing production or consumption) it could then target support to those alternatives that use the cheapest feedstocks, have logistical advantages or high yields. That is, encourage specialization in ways that minimize disadvantages.

LikeLiked by 1 person

Increasing energy efficiency is certainly part of R&D. I know, for example, from our BIO-TIC roadmapping project that energy costs can be reduced by: “using low-energy consuming systems including anaerobic conversion. Such systems consume substantially less energy because oxygen does not have to be actively supplied to the fermentor media.”

Still, it is not obvious to me whether this R&D step is most important in progressing down the learning curve, reducing total costs (including energy). What would happen in an international R&D ‘race to the market’ if EU policy makers would prioritse R&D topics in this way? The risk is, it seems, that this would, unintentionally, decrease competitive advantage in international markets alltogether.

Of course this would not be a problem if:

1) on a long term energy / feedstock costs will eventually become a bigger and bigger burden for all (due to climate change, resource scarcity or what have you)

2) the EU industry would be able to survive the current investment climate.

An alternative / somewhat related strategy: avoiding head-on global competition, and building a protected EU innovation (eco) system that hinges on the presence / development of regional feedstock, efficient logistics and strong homemarkets. For this , much more is needed than R&D support.

Just some thoughts …

LikeLike

There are a number of agendas that might lead to such an approach; region-led ‘smart specialization’ and EU/MS ‘self sufficiency’ agendas relating to resources might do so. We are going to try to follow the consequences of those agendas (and countervailing ones like global competitiveness/market-driven approaches) in the scenarios I hope. Europe has a, shall we say, ‘rich’ politics around these kinds of questions!

LikeLiked by 1 person

As mentioned in your article, the US and Europe are considered leading in the field of bio-based R&D. It is unfortuntaley not translated in industrialization. A recent study by the Nova Institute indicated that the regional development of production capacities in 2013 was estimated to be: Asia (51.4%), US (18.4%), Europe (17.3%) and South America (12.2%). In 2018, it will be even more unbalanced: Asia (75,8%) for Europe (7.6%).

One of the main problem in Europe being the lack of consensus regarding regulations, legislations and standardizations. Even European companies invest in the US, where there are many incetives also from the government, and in Asia.

LikeLike

Thanks for your contribution Marjorie. Always good to have a quantitative overview of things. The extrapolations pose a bleak future for Europe’s envisioned biobased economy. On the other hand, we are still talking about an industry that is small in absolute terms, and largely driven by government created markets. Strictly speaking Europe can still play its part. If it is politically willing to invest not just in R&D but also in markets and infrastructure development. (Not an easy challenge for a divided continent, but is there an alternative?))

LikeLike

Some news from the biobased practice which fits nicely with the first reply of Jesse on this blog: two weeks ago I had an interview with a Dutch company who is looking for a place to build their first commercial plant for the production of their biobased product. First, they have been thinking about the USA, because of the cheap energy, availability of feedstock. But now, they are orienting again on the European continent. The idea is now to build a plant which is energy price robust in the sense that it produces the energy it needs for the process by using side streams of the process. Besides that, they want to profit from existing infrastructure and probably also subsidies from the EC by retrofitting an exisiting plant…

A small question to to the post of Marjorie:

I was wondering how these percentages for biobased production capacities you are mentioning for these different global regions are in absolute terms…

LikeLike

Pingback: About the Insight Refinery | The Insight Refinery