Introduction

As explained in the previous blog post, I will look closely to the role of ‘shared piloting facilities’ in the biobased innovation system. Table 1 provides a selection of such facilities that currently exist within Europe. This article will focus entirely on the Bio Base Europe Plant in Ghent.

All information on this facility was derived from a very detailed assessment report resulting from the multi-ket-pilot-lines project:

http://www.mkpl.eu/results/demonstrators/

Table 1: Selection of shared piloting facilities

| Bio Base Europe Pilot Plant | Ghent, Belgium / Terneuzen, NL |

| CPI | UK |

| Bio-economy pilot line | Aalto, Finland (VTT) |

| Chempolis Ltd | Oulu, Finland |

| ARD Agro-Industrie Recherches et Développements | Reims, France |

| CBP Center for Chemical-Biotechnological Processes | Leuna, Germany (hosted by Fhf) |

| Bio Process Pilot Facility | Delft, the Netherlands |

| Biorefinery of the future / SEKAB | Örnsköldsvik, Sweden (hosted by SP) |

Specific questions to be answered

- What role do these shared piloting facilities play in the Eureopan biobased innovation system?

- What are the best practices and lessons learnt with respect to these facilities?

- How do these (combined) facilities connect to the (future) role of AERTOS RTOs?

Topics to be covered

- History

- Purpose

- Services provided

- How does it fit within the ecosystem

- Technology, Equipment

- Overview

- Unique selling point

- Organisation, Staff, Business, Finance

- Ownership

- Business Case / Funding (public / private)

- Client base / Market perspective

- Lessons learnt

- Best practices

- Do’s and dont’s

History

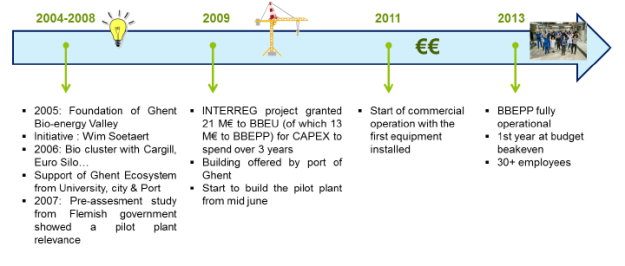

Bio Base Europe Pilot Plant is a not-for-profit organization located in Ghent, Belgium. It officially started up as part of a 2009 INTERREG IV European project, together with the Bio Base Europe Training Centre located in Terneuzen, The Netherlands.

The plant is located in the port of Ghent in a former fire station. It has been converted into a biochemical transformation facility with an analytical lab and 3 different process halls of over 1700 m2, equipped with state-of-the-art equipment. Most of the equipment and utilities were installed between 2009 and 2011. The plant became fully operational in 2012.

Purpose

The facility is “open” to customers without restriction (within the limits of their business model and operating procedures). As such Bio Base Europe Pilot Plant is a multi-user “pilot plant”, or scale up facility. A mix of industrial and academic customers can access the facility in order to close the gap between scientific feasibility and industrial application of new biotechnological processes.

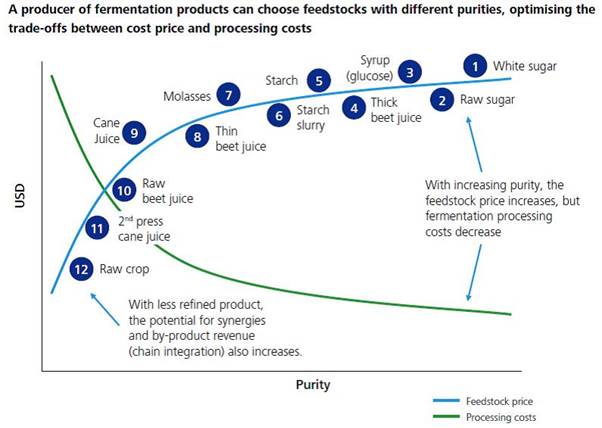

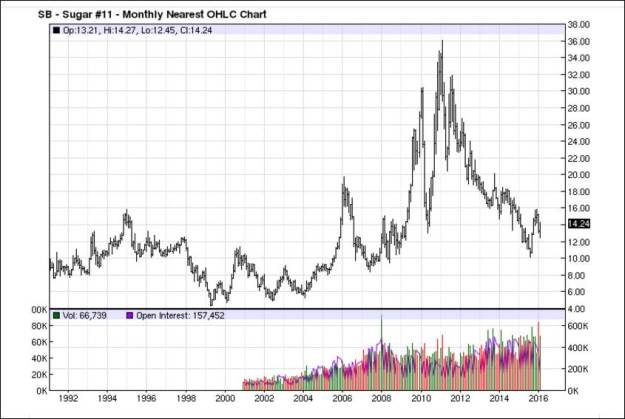

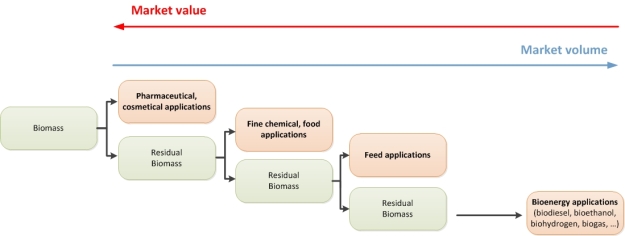

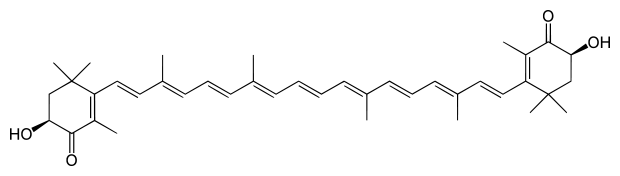

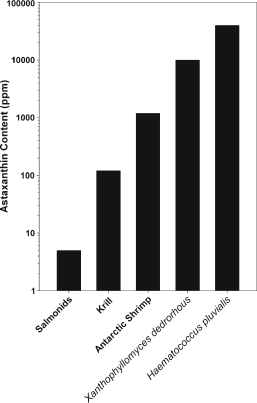

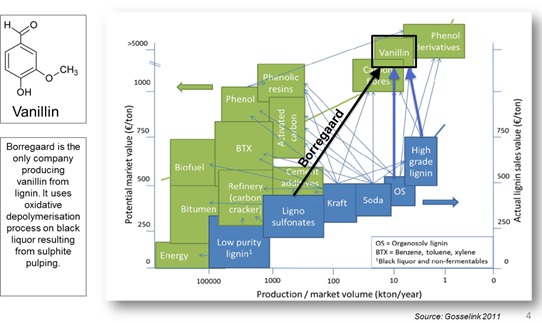

The focus lies on biochemical conversion of abundantly available 1st generation substrates to high added value molecules and converting second generation substrates such as agricultural waste products and non-food crops into renewable products like biofuels, bioplastics, biosolvents.

BBEPP positions itself as a one-stop-shop meaning that it covers the entire process chain in a single plant, from the biomass up to the final bio product. All equipment needed is available in one place, from upstream to downstream and from lab-scale to pre-industrial scale. To allow for flexibility, each piece of equipment is modular, put on a skid and many are placed on wheels to allow for re-positioning according to the configuration desired by the customer.

The services provided are mainly focused on two deliverables: delivery of the physical end product and the transfer of know-how concerning the process. The know-how is detailed in a full set of documentation which includes elaborate reports, protocols, mass balances and equipment specifications that constitute a complete technology transfer. The protocols, the list of tasks and deliverables, the timing, price and reporting are discussed when setting up the partnership.

Technology, Equipment

Bio Base Europe Pilot Plant is a facility that operates using diversified process equipment from kilogram scale to ton scale as a service for the development of the bio based economy. The pilot plant allows its customers to assess specific strengths and weaknesses of new biotechnological processes before making costly, large-scale investments. The development services provided are positioned between late stage research and pre-market industrial development (TRL 4 to 7).

Bio-based processing is typically a series of individual process steps that are executed in different equipment or vessels. In a full scale production bio-refinery, the production vessels are positioned one after the other in the sequence of the process steps. In the development phase at the pilot plant, the sequence of processes can vary according to specific needs of the various starting materials and the end-products. Thanks to the high degree of modularity and the completeness of the equipment set, BBEPP can market themselves as a one-stop shop.

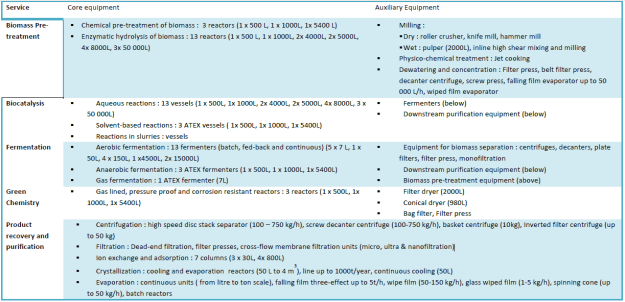

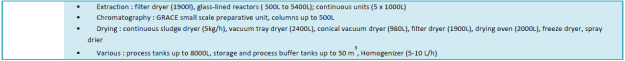

BBEPP is equipped with modular, multi-purpose, industrial equipment to cover a broad range of bio-based processing for industrial applications. At the start of BBEPP, a specific budgetary envelope was reserved for the purchase of the required equipment and installation. Table 3 provides a list of equipment specifications.

Table 3: List of equipment

Organization and staff

The key supporting agencies / partners at the start of BBEPP include:

- Ghent Bio Economy Valley, the local bio base cluster

- The port of Ghent, where BBEPP is located

- The city of Ghent, the Province of East Flanders

- Enterprise Flanders and IWT (agency for innovation by science and technology), regional funding agencies that support BBEPP

- The University of Ghent, where BBEPP does a large part of its scientific resourcing.

These entities supported BBEPP from the start and are still guiding its business plan as board of directors. These partners are public agencies, making therefore BBEPP independent from any industrial company. BBEPP makes sure that it is not serving one big unique customer in order to keep its independence. At the time of writing (2013) the facility had a staff of 35-40 persons. The team was split between administration, finance staff (6 persons), Business development & communication (2 persons), research & development (20 persons) Operations, Maintenance and Engineering (9 persons). At the beginning, a larger share of the staff was made up of engineers and operators dedicated to the installation of the equipment.

Business and finance

BBEPP was a publicly funded organization at the outset, but with “one-shot” capital subsidies. In total, the BBE project received around 13 M€ of public funding from European Union (via INTERREG), East-Flanders, and Ghent. (With a total budget of 21M€, 13M€ went to Bio Base Europe Pilot Plant and 8 M€ to Bio Base Europe Training Centre.) The year 2013 was BBEPP’s first year of operational break even with a budget of 4.6M€. On the side of the expenses, almost 2.8 M€ were due to equipment and infrastructure depreciation, utilities and maintenance and more than 1.7 M€ for staff expenses.

With respect to income, BBEPP keeps a balance of (50%/50%) between public and private contracts. In 2013 the BBEPP received almost 1.9 M€ in private contracts. Of this amount, approximately two thirds came from large enterprises, which represent 1/3 of BBEPP customers. Only one third of contract revenue was from SMEs, which represents 2/3 of BBEPP customers. About 75% of BBEPP clients are situated from a radius of 200km.

The most important value-added for customers is accessing faster manufacturing learning curves and quicker time to market. The industrial outcome is equally split between the setting up of a new production line and the optimization/ adaptation of an existing on (medium and large enterprises). For start-ups and SMEs, scale-up often enables the company to test stabilized products with potential customers, triggering possible contracts and engagement, which is an essential step before convincing an investor to pour money into a new production line. The typical contract for a large enterprise is around 100k-200k€, whereas for an SME it goes from 5k€, with an average around 25 k€. Sharing fixed costs is part of BBEPP’s value proposition. In comparison, the cost of building up one’s own pilot would typically cost between 500 k€ and 5 M€.

After five years of operation, BBEPP was able to cover its annual operating costs with contract revenue. However, depreciation cost are not covered by contracts, so upgrades or investments in new capital equipment and facilities are not possible without assistance from external bodies, either public or private. BBEPP will certainly need a regular public funding of CAPEX to be sustainable in the future as non-profit regulations do not allow BBEPP to build up capital from revenues year over year to be able to invest in new equipment.

Lessons learnt

The following section lists some key lessons learnt that were developed as part of the on-going activities:

There is added value in building up and sharing non-proprietary know-how

The most significant distinguishing characteristic of BBEPP with respect to the competition is its high level of expertise in industrial biotech. BBEPP develops and tests processes as a typical contract manufacturer would do, and in addition shares and transfers non-proprietary know-how as a major part of the added-value delivered to industrial customers and academic partners alike.

Maintaining know-how

BBEPP is developing process know-how in the bio-based industry, thanks to its staff expertise and is keeping it “state-of-the-art” thanks to public R&D projects and experience with customers’ scale-up runs. This know-how is transferred to customers. This is differentiating the shared facility proposition from contract manufacturing (i.e. by competitors).

Serving multiple ecosystem functions

Today the facility is running on the basis of a combination of publically financed R&D projects and industrial contracts, covering a broad range of customers and markets. This mix of projects is critical for serving a variety of ecosystem functions. For example:

- Public projects give BBEPP the necessary visibility to attract potential private customers. Most private customers of BBEPP do not want to communicate on their experiences.

- With respect to private customers, large enterprises are essential for financial sustainability. These customers can finance 100kEUR plus projects necessary to stay in business.

- The facility serves a majority of SMEs. An interesting lesson is the so called “coupon scheme”, which provides start-ups with a 10-30k€ voucher, sponsored by a government, for a scale-up experiment at BBEPP. These dedicated subsidies enabled BBEPP to offer its services to start-ups.

Independence, IP and confidentiality as key boundary conditions

From the beginning of the project, BBEPP chose to be independent of any industrial shareholders. Thus, BBEPP can work equally with any company. For certain companies, it ensures that their know-how will not be taken and used by a competitor. For the public funding agencies of BBEPP, it ensures that their investment will be used equally by SMEs, and big companies with no preferences towards a specific consortium of enterprises. BBEPP generally grants industrial property rights developed along projects to its customers. The customer requirements for confidentiality continually increase as the activity moves closer to market. Therefore service agreements with customers include confidentiality clauses and BBEPP generally does not take any IP. Of course this is more limited in the case of public-funded projects where transparency and openness are required.

Staff

The hiring process for a new structure like BBEPP is difficult: it is crucial to find the right people, and a good mix between young inexperienced but enthusiastic people and experienced process engineers. Contacts with universities and other academic partners were used to find new candidates, as well as networking and word of mouth.

Equipment acquisition

Based on experience and estimations, a list of equipment to acquire was made, this equipment was assessed to cover the needs of future customers, this is an estimated guess. For certain unit operations, second hand equipment was selected instead of new equipment in order to keep the overall project within budget and still to be able to offer a “one-stop shop” concept. Modular equipment enable its staff to offer quickly customized testing to its customers. The next step for BBEPP to take would imply bigger equipment aiming for custom manufacturing. This would be the last scale-up step for big volume industries, with the ambition to cover developments beyond TRL7 to TRL8 (enabling final scale product demonstration), and would enable custom manufacturing services, which could represent a base revenue stream for BBEPP.

Without multiple funding sources, BBEPP would not have been possible.

The initial investment in capital needed to create a pilot plant of meaningful size is significant. A pilot facility needs a large set of equipment and skilled people to run the pilot processes. A facility like the BBEPP has substantial fixed costs, so critical mass and size is key to being both viable and effective. At the time of inception of BBEPP, no single government funding agency had the programmes or measures in place to support such an initiative. BBEPP was made possible by combining various sources of public funding. Even today, despite the facility covering its operational costs, capital and equipment depreciation are not covered by contracts, so upgrades or investments in new capital equipment and facilities will not be possible without finding additional capital injections.

Agro-food sector requirements

The agro-food sector demands special quality requirements, particularly in terms of norms and standards. Though BBEPP is already addressing the scale-up of sub-products for the agro food industry, scaling-up final product for this sector requires standardized quality processes. BBEPP is currently working on getting approved for this sector in order to address a broader range of customers.